Bad Advice Costs Small Businesses $12 Billion In Higher Health Insurance Premiums

Last week, the National Small Business Association (NSBA) published the 2014 Small Business Health Care Survey. The survey of 780 small businesses illustrated the health insurance challenges they face today. Two findings in particular caught our attention:

- Surveyed companies spent $1121/month per employee on small business health insurance costs

- 74% of businesses bought the insurance from a local broker

Why is this important? NSBA member businesses are getting bad advice from traditional insurance brokers, resulting in nearly $12 billion per year in higher health insurance expenses.

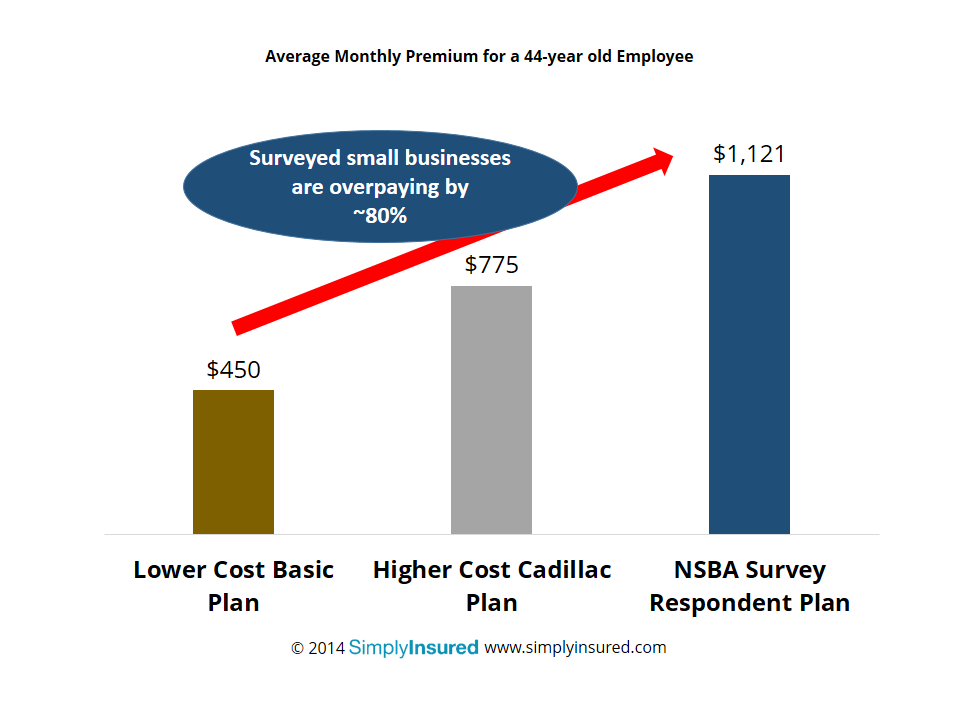

Small Businesses Overpaid by 80% for Health Insurance

In the NSBA survey, small businesses reported average health insurance premiums of $1121/month to cover a 44-year old employee. That’s ~80% higher than the cost of most insurance plans. Using SimplyInsured’s small business health insurance premium database, the cost to cover a 44-year old employee should start at $450/month for a lower-cost basic plan and top out at $775/month for a high-end cadillac plan.

NBSA Members Paid ~80% Higher Premiums Than Comparable Plans

The Cost to Small Businesses: $12B in Extra Health Insurance Premiums

The unnecessary extra health insurance expense takes a significant toll on small businesses. Collectively, 65000 NSBA members will spend an extra ~$11.5 billion on health insurance premiums. That’s a significant sum of money that could have been invested in business growth or higher employee wages.

Small Businesses Could Save $6200/Employee, NSBA Members Could Save $12B Per Year

With the same amount of money spent per employee, small businesses could have:

- Purchased a platinum-tier health insurance plan

- Contributed the max $2500 to a flexible spending account

- Still saved $1700 for the business (13% savings)

Why Do Small Businesses Overpay? Bad Advice from An Insurance Broker

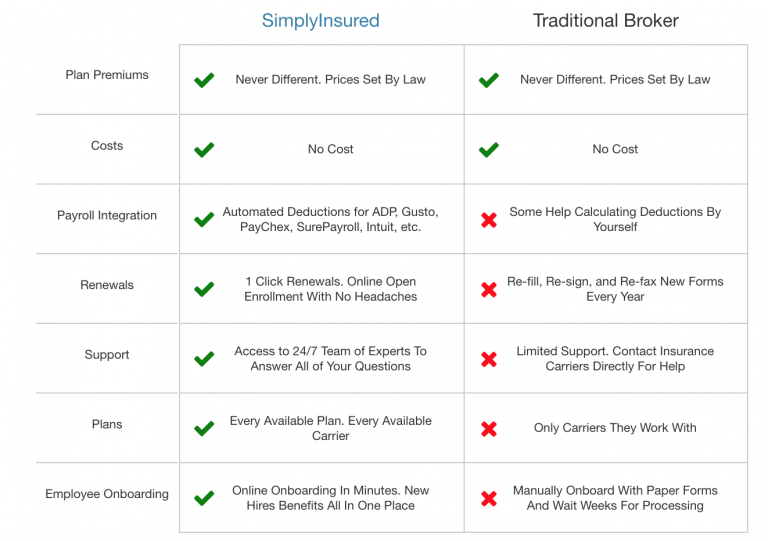

How did these small businesses end up overpaying by so much? The most likely culprit – bad advice from an insurance broker. The NSBA survey showed 76% of companies purchased health insurance from a traditional insurance broker, and planned to use the same broker for the next plan. That’s not surprising, as 72% of small business owners manage their own benefit offerings.

However, traditional insurance brokers have several limitations, and the bad advice can easily lead to higher health insurance costs. A traditional broker’s biggest limitation is their inability to access, review, and analyze the hundreds of available small business insurance plans. Typically, traditional brokers are only familiar with a limited set of plans, and do not look beyond those plans to find better options. Less work for your broker, but higher costs for your business.

Make Sure Your Business Isn’t Overpaying for Health Insurance

Small businesses who overpay for health insurance end up facing difficult choices. The NSBA survey showed small businesses are considering reducing benefits, increasing employee contributions, or accepting less profit in their business as a result of high insurance costs. Capturing the savings available through lower health insurance premiums is one way for small businesses to mitigate the impact of these tough decisions.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Make sure you’re not overpaying for health insurance! Get an instant price check to compare against your existing health insurance plan costs? Get an instant quote at www.simplyinsured.com